Unlocking the Benefits of Debt Consolidation in the UK: A Strategic Guide

Debt consolidation is increasingly viewed as an essential financial strategy designed for individuals facing the considerable burden of managing multiple debts. This method involves combining several debts into one single loan, which generally offers a lower interest rate. By simplifying the structure of monthly payments, it not only enhances the repayment process but also provides the opportunity for significant long-term savings. The primary goal is to create a sustainable repayment plan that enables individuals to regain control over their financial situations, ultimately paving the way for a more secure financial future. With this approach, individuals can experience reduced stress levels and a clearer path towards financial recovery.

While the appeal of debt consolidation is strong, it is crucial to dispel common misconceptions about debt consolidation to understand its true nature. Many people mistakenly consider debt consolidation as a quick fix for financial issues, assuming it is a simple solution. In reality, effective debt consolidation requires careful planning, steadfast commitment, and sound financial management. Without these vital elements, individuals risk worsening their financial troubles rather than alleviating them. Thus, it is important to engage with this process equipped with a comprehensive understanding of its implications and responsibilities.

Considering debt consolidation involves a careful evaluation of its benefits and potential downsides. On the positive side, consolidating debts can lead to lower <a href=”https://www.debtconsolidationloans.co.uk/debt-consolidation-with-variable-interest-rates-a-guide/”>interest rates</a>, which can lessen monthly financial obligations. This increased flexibility can enhance cash flow, allowing for more funds to be allocated towards essential expenditures or savings. However, if not managed wisely, debt consolidation can create a false sense of security, leading to further debt accumulation. A thorough understanding of these complexities is essential for anyone considering this financial strategy.

Understanding the Core Principles of Debt Consolidation

At its essence, debt consolidation is a financial strategy focused on merging multiple debts into a single, manageable loan. This can be achieved through various means, including personal loans, balance transfer credit cards, or secured loans against valuable assets such as property. The main objective is to reduce the overall interest rate associated with these debts, making monthly repayments more attainable. For many individuals across the UK, this approach offers a crucial opportunity to simplify their financial obligations while alleviating the psychological weight of debt.

The debt consolidation process is generally straightforward: it entails replacing multiple high-interest debts with a single loan that typically offers a lower interest rate. This shift not only simplifies the repayment process but also holds the potential to generate significant long-term savings. However, it is vital to acknowledge that this strategy is not without its obstacles. The successful execution of debt consolidation heavily relies on a comprehensive assessment of one’s financial status and diligent management of the newly acquired debt.

Beyond the financial aspects, there is a psychological dimension that must be taken into account when consolidating debt. For numerous individuals weighed down by the stress of multiple debts, this process can provide a much-needed emotional boost. Simplifying payment schedules can significantly reduce anxiety, allowing individuals to focus on other essential areas of their lives. Nonetheless, it is crucial to recognise that this relief might only be temporary if the underlying financial habits are not effectively addressed and transformed.

Clearing Up Misconceptions Surrounding Debt Consolidation

The field of debt consolidation is rife with misconceptions that can prevent individuals from exploring beneficial options. One of the most common myths is that debt consolidation provides an instant solution to financial challenges. In truth, it acts as a tool that requires responsible management and application. It is not a miraculous fix but rather a means to manage existing debts more effectively. Each individual must embark on this journey with financial discipline and commitment to achieve favourable outcomes.

Another widespread misunderstanding is the belief that debt consolidation completely eliminates debt. While it can streamline payments and lower interest rates, it does not erase the underlying financial obligations. The debts themselves remain; they have simply been reorganised into a single repayment structure. Misunderstanding this key detail may lead individuals to incur additional debts post-consolidation, mistakenly believing they are free from financial obligations, which can complicate their financial situations further.

Furthermore, there is a tendency to confuse debt consolidation with bankruptcy, which is a significant misrepresentation. Although both strategies aim to address financial distress, they represent fundamentally different approaches. Bankruptcy is a legal process that can have long-lasting negative effects on one’s credit score and overall financial future, whereas debt consolidation, when managed correctly, can enhance creditworthiness and support long-term financial stability.

Evaluating the Pros and Cons of Debt Consolidation

A deeper look into the advantages of debt consolidation reveals a way to achieve enhanced financial clarity. One significant benefit is the ability to secure lower interest rates. By consolidating high-interest debts into a single loan with a reduced rate, individuals can experience substantial savings over time. This strategic approach can lead to significantly lower monthly payments, thereby freeing up disposable income for essential expenses or savings initiatives.

Nonetheless, the risks associated with debt consolidation should not be underestimated. Without a clear and actionable strategy, individuals may find themselves merely swapping old debts for new ones, perpetuating a cycle of financial instability. It is essential to conduct a thorough analysis of one’s spending habits and overall financial health before pursuing this option. Effective management and a commitment to addressing underlying financial behaviours are crucial for fully realising the benefits of consolidation.

Moreover, while debt consolidation simplifies payment processes, it does not address the root causes of debt accumulation. Individuals must embrace a proactive approach to their finances, ensuring they do not revert to previous harmful habits. This highlights the importance of financial discipline and literacy in successfully navigating the complexities of debt consolidation.

Distinguishing Facts from Fiction in Debt Consolidation

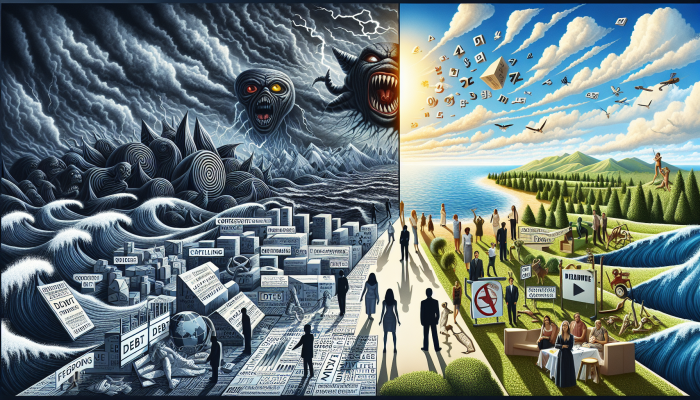

In the domain of personal finance, alarming tales often overshadow rational discussions about debt consolidation. However, the reality is much more nuanced and multi-faceted. Numerous horror stories are exaggerated, perpetuating misconceptions that may deter individuals from considering legitimate avenues for effective debt management. Recognising the stark differences between these sensationalised accounts and the actual outcomes of debt consolidation is crucial for making well-informed financial decisions.

Identifying Exaggerated Narratives in Debt Consolidation

A significant portion of the fear surrounding debt consolidation arises from exaggerated claims prevalent in mainstream media and online conversations. These horror stories often focus on extreme cases where individuals faced severe consequences after opting for consolidation, presenting a skewed view of the practice. While it is true that some people have encountered negative outcomes, these instances do not reflect the experiences of the broader population.

In many cases, the individuals highlighted in these narratives failed to address the root causes of their debts, such as poor spending habits or insufficient financial literacy. By concentrating solely on the negative aspects, these accounts neglect the numerous individuals who have successfully navigated the debt consolidation process and emerged with improved financial situations. This creates a climate of fear that can discourage individuals from pursuing effective debt management strategies.

Additionally, sensationalism can cloud the true nature of debt consolidation. It is vital to differentiate between reputable consolidation options and dubious schemes that promise unrealistic outcomes. By recognising the signs of trustworthy debt consolidation services, individuals can protect themselves from scams and make informed choices that positively influence their financial futures.

Real-Life Success Narratives of Debt Consolidation

In stark contrast to the horror stories frequently circulated, there are numerous examples of UK residents who have successfully utilised debt consolidation to regain control over their financial lives. Many individuals have shared their personal journeys, demonstrating how this approach can yield positive results when executed effectively. These real-life narratives serve as a powerful reminder that while debt consolidation is not a universal solution, it can be an incredibly effective strategy for those willing to commit to responsible financial practices.

For instance, a couple burdened by numerous credit card debts turned to debt consolidation to streamline their financial commitments. By securing a personal loan with a significantly lower interest rate, they managed to reduce their monthly payments and gain clarity in their budgeting. As they consistently made payments, they not only improved their financial situation but also learned invaluable lessons regarding responsible spending and saving.

These success stories underscore the importance of approaching debt consolidation with a well-defined plan and the right mindset. For those who invest time in educating themselves about their options and commit to responsible financial habits, the outcomes can be transformative, leading to lasting change.

Lessons Learned from Debt Consolidation Experiences

Learning from the experiences of others is invaluable, particularly when navigating the complex landscape of debt consolidation. The stories of individuals who have faced challenges during their consolidation journeys provide critical insights into pitfalls to avoid. For instance, many have learned that neglecting to confront their underlying spending habits can lead to further financial troubles and setbacks.

Moreover, recognising that debt consolidation is not a one-size-fits-all solution is essential. Each individual's financial situation is unique, and a strategy that works for one person may not suit another. By examining a variety of case studies, potential consolidators can identify strategies that resonate with their circumstances, thereby facilitating well-informed decisions.

Additionally, these lessons extend beyond personal experiences; they highlight the importance of seeking guidance from regulated financial advisors who can offer tailored recommendations. This proactive approach can significantly increase the likelihood of a successful debt consolidation journey, contributing to long-term financial stability and peace of mind.

The Role of Media in Shaping Public Perception of Debt Consolidation

The media plays a significant role in shaping public perceptions of debt consolidation. While it serves as a platform for disseminating information, sensationalised narratives of financial ruin can foster widespread misconceptions. News stories often highlight negative outcomes, overshadowing the positive experiences that many individuals encounter. This focus on horror stories can distort public perception, discouraging those in need of assistance from exploring legitimate debt consolidation options.

A more balanced portrayal of debt consolidation in the media is essential for promoting informed decision-making. By showcasing both success stories and challenges, the media can present a more comprehensive view of what debt consolidation truly involves. This shift in narrative can empower individuals to take control of their finances, motivating them to explore options that lead to positive results and improved financial health.

Furthermore, consumers should approach media narratives with a critical mindset, recognising that personal finance is inherently an individualised experience. While horror stories may resonate with some, they do not encompass the entirety of the debt consolidation landscape. By remaining informed and open-minded, individuals can better navigate their financial journeys and pursue effective strategies for managing debt.

The Regulatory Framework Governing Debt Consolidation in the UK

Navigating the world of debt consolidation requires a solid understanding of the regulatory framework in the UK. The Financial Conduct Authority (FCA) plays a pivotal role in regulating debt consolidation providers, ensuring that consumers are protected from unfair practices. This regulatory framework is designed to foster transparency and ethical conduct within the industry, safeguarding consumers as they strive to manage their debts effectively.

The Importance of the Financial Conduct Authority in Debt Consolidation

The FCA serves as the regulatory body responsible for supervising financial services in the UK, including practices related to debt consolidation. Its primary goal is to protect consumers, maintain market integrity, and promote competition. By enforcing stringent standards for financial firms, the FCA ensures that consumers receive fair and transparent treatment throughout the debt consolidation process, thereby fostering trust in the system.

For individuals contemplating consolidation, it is essential to comprehend the FCA's role. The regulator mandates that all debt consolidation providers adhere to specific guidelines, including the requirement to provide clear information regarding costs, fees, and repayment terms. This transparency empowers consumers to make informed decisions about their financial options, ultimately leading to more favourable outcomes.

In addition to protecting consumers from unscrupulous practices, the FCA’s oversight helps to eliminate fraudulent providers who prey on vulnerable individuals. By ensuring that only reputable firms can operate within the market, the FCA diligently works to shield consumers from scams and guarantees they receive the necessary support to manage their debts responsibly and effectively.

Understanding Consumer Rights in Debt Consolidation

In the UK, consumers are endowed with a suite of rights designed to protect them from unfair practices when engaging with debt consolidation companies. These rights empower individuals to seek redress and ensure they are treated fairly throughout the consolidation process. Familiarising oneself with these rights is crucial for navigating options with confidence and effectiveness.

One of the fundamental consumer rights is the right to clear and accurate information. Debt consolidation providers are obliged to provide transparent details about their services, including associated costs and terms. This accountability enables consumers to compare various providers and make informed decisions based on their unique financial situations.

Moreover, consumers have the right to lodge complaints if they believe they have been treated unfairly. Regulatory bodies such as the FCA offer mechanisms for individuals to report grievances, ensuring that their concerns are taken seriously. This protective framework fosters a sense of security for those considering debt consolidation, allowing them to pursue their financial goals without fear of exploitation or misconduct.

The Importance of Seeking Professional Financial Advice

Before embarking on a debt consolidation journey, it is essential for individuals to seek counsel from regulated financial advisors. These professionals possess the expertise necessary to guide consumers through the complexities of debt management, ensuring they make well-informed choices tailored to their unique circumstances. By leveraging expert advice, individuals can significantly enhance their prospects of achieving a successful debt consolidation experience.

In the UK, numerous organisations offer free or low-cost financial advisory services. These resources can assist individuals in assessing their financial situations, outlining potential strategies, and clarifying the best consolidation options available. By collaborating with regulated advisors, consumers can gain valuable insights into their choices, facilitating effective navigation of the often-confusing landscape of debt consolidation.

Furthermore, seeking professional guidance can help individuals avoid falling victim to scams or misleading offers. Financial advisors can assist in identifying reputable debt consolidation providers and ensure that consumers are well-informed about their rights and options. This proactive approach can lead to healthier financial outcomes and alleviate the stress associated with managing debt.

Choosing the Right Debt Consolidation Option for Your Financial Needs

Selecting the most appropriate debt consolidation option is a pivotal step on the path to achieving financial stability. With a multitude of avenues available, individuals must carefully assess their options to ensure they align with their specific circumstances and financial goals.

Exploring Different Types of Debt Consolidation Loans

In the UK, a wide array of debt consolidation loans is available to assist individuals in effectively managing their debts. Each option presents its unique advantages and disadvantages, making it crucial for consumers to understand the differences between them.

Personal loans rank among the most common forms of debt consolidation. These loans provide a lump sum of money that can be used to pay off existing debts, allowing individuals to consolidate their payments into a single monthly instalment. Generally, these loans come with fixed interest rates, offering predictability in repayment.

Home equity loans present another option for property owners. By leveraging the equity in their homes, individuals can secure loans at typically lower interest rates. However, this approach carries inherent risks, as failure to repay the loan could lead to the loss of the property.

<a href=”https://limitsofstrategy.com/debt-consolidation-with-bad-credit-a-uk-guide-to-start/”>Balance transfer credit cards</a> are also a popular choice, enabling individuals to transfer existing credit card debts onto a new card with a reduced interest rate. While this option can offer temporary relief, it is imperative to remain vigilant about any associated fees and the terms of the promotional rate.

Ultimately, the most suitable consolidation option will depend on an individual’s financial situation, preferences, and long-term goals. Careful consideration of each choice will empower consumers to make informed decisions that pave the way toward financial stability and independence.

Comparing Interest Rates for Better Financial Decisions

When considering debt consolidation, comparing interest rates becomes a crucial step that can significantly affect long-term financial outcomes. Not all providers offer the same rates, and even slight differences can lead to substantial savings over time.

To make an informed choice, individuals should gather quotes from multiple lenders, taking into account not only interest rates but also any associated fees. This thorough approach ensures that consumers can accurately assess the total cost of borrowing and identify the most advantageous options available to them.

Moreover, understanding the methodology behind interest rates is essential. Fixed rates provide predictability, while variable rates may fluctuate over time, potentially increasing overall costs. By carefully weighing these factors, individuals can select a consolidation option that aligns with their risk tolerance and financial objectives.

In addition to interest rates, consumers should also evaluate the overall terms of the consolidation loan. Aspects such as repayment periods and the flexibility to make additional payments can significantly influence the long-term affordability and effectiveness of the solution. Conducting thorough research and consulting with financial advisors can greatly assist individuals in effectively navigating this complex landscape.

Evaluating Fees and Charges in Debt Consolidation

Hidden fees can substantially undermine the benefits of debt consolidation, making it vital for individuals to meticulously assess all associated costs. While a low interest rate may initially seem appealing, additional charges can erode potential savings and lead to unexpected financial burdens.

Before committing to a consolidation option, individuals should carefully review the terms of the loan or credit agreement, looking for any clauses that might incur fees. These may include arrangement fees, early repayment penalties, or account maintenance charges. By identifying these costs upfront, consumers can make more informed decisions regarding their financial commitments.

Furthermore, seeking clarity from providers about their fee structures is advisable. Reputable debt consolidation companies should offer clear, upfront information regarding all costs associated with the process. If any elements appear ambiguous or hidden, individuals should exercise caution and consider alternative options.

Engaging with financial advisors can also facilitate effective navigation of the fee landscape. Advisors can provide insights into which fees are standard versus excessive, empowering consumers to make choices that optimise their financial outcomes in the long term.

Assessing Repayment Terms for Sustainable Financial Health

The repayment terms of a debt consolidation loan can significantly impact an individual’s long-term financial health. Each consolidation option presents unique repayment structures, making it essential for individuals to fully understand these terms prior to making decisions.

When evaluating repayment terms, individuals should consider the length of the repayment period. Longer repayment terms may yield lower monthly payments but can result in higher overall interest costs. Conversely, shorter terms may entail higher monthly payments but can ultimately save money in interest over the life of the loan.

Flexibility is another key consideration. Some consolidation options allow for additional payments without penalties, which can be beneficial for individuals aiming to eliminate debts more swiftly. Understanding the terms regarding prepayment and additional contributions can enable consumers to develop a repayment strategy that aligns with their financial goals.

Moreover, it is crucial to assess the implications of missed payments. Understanding the consequences of defaulting on payments can help individuals prepare for contingencies and prevent exacerbating their financial situations.

Ultimately, a careful evaluation of repayment terms will contribute to a more sustainable debt management strategy, allowing individuals to regain control over their finances and work towards lasting financial stability.

Empowering Transformations: Success Stories from UK Residents

While horror stories may dominate discussions about debt consolidation, a wealth of success stories exists that illustrate the potential benefits of this financial strategy. These real-life examples highlight that with the right approach and mindset, individuals can overcome their financial challenges and achieve meaningful transformation.

Case Study: Successfully Managing Multiple Debts

One inspiring case comes from a UK resident who faced the daunting task of juggling multiple high-interest debts from credit cards and personal loans. Overwhelmed by the pressure of monthly payments and escalating interest rates, she sought a solution through debt consolidation.

After conducting thorough research, she secured a personal loan with a significantly lower interest rate. Using this loan to pay off her existing debts, she streamlined her finances into a single monthly payment. This not only alleviated her immediate financial strain but also provided her with a clearer understanding of her budgeting and spending habits.

Through disciplined repayment practices, she successfully eliminated her debts within a few years. Furthermore, this experience imparted valuable lessons about financial management, motivating her to adopt a more frugal lifestyle and prioritise savings. Her success story exemplifies that when approached responsibly and diligently, debt consolidation can be a powerful tool for reclaiming control over one’s financial situation.

Case Study: Improving Credit Scores through Debt Consolidation

Another remarkable success narrative involves an individual who used debt consolidation to significantly enhance their credit score. After falling behind on payments due to unexpected financial challenges, their credit score plummeted, making it increasingly difficult to secure additional loans or credit. Recognising the need for change, they opted for debt consolidation to restore their financial stability.

By consolidating their debts into a single personal loan, they were able to make consistent monthly payments. This regularity not only helped restore their creditworthiness but also improved their overall financial health. Over time, as they diligently repaid the loan, their credit score steadily increased, ultimately qualifying them for more favourable interest rates on future lending opportunities.

This case underscores the importance of viewing debt consolidation as a strategic tool rather than merely a last resort. When executed correctly, it can profoundly impact one’s credit profile, unlocking access to more advantageous financial opportunities.

Case Study: Achieving Financial Freedom through Debt Consolidation

A UK family faced significant financial hurdles due to mounting debts from various sources. With multiple loans and credit cards depleting their resources, they felt trapped in a relentless cycle of repayments. Determined to achieve financial freedom, they decided to pursue debt consolidation to simplify their financial obligations.

After consulting with a financial advisor, they secured a consolidation loan featuring a lower interest rate, significantly reducing their monthly payments. This newfound financial flexibility enabled them to allocate more funds towards essential expenses and savings.

As they successfully navigated their repayment journey, they gained invaluable insights into budgeting and responsible spending. Over time, they achieved debt-free status and redirected their efforts towards building a more secure financial future. Their story serves as a testament to the transformative potential of debt consolidation when combined with proactive financial management and commitment.

Avoiding Common Traps in Debt Consolidation

While debt consolidation can serve as a crucial lifeline for individuals grappling with financial burdens, it is vital to be aware of common pitfalls that can undermine its effectiveness. By proactively addressing these challenges, individuals can maximise their chances of achieving lasting financial stability and success.

Failing to Address Underlying Spending Habits

One of the most significant pitfalls encountered during the debt consolidation process is the failure to confront underlying spending habits. While consolidating debts can provide relief by simplifying payments, it does not resolve the root causes of financial distress and overspending.

Many individuals find themselves reverting to old spending patterns, often leading to the accumulation of new debts after consolidation. This cycle can create a misleading sense of security, as individuals may believe they are on the right path simply because they have consolidated their debts.

To break free from this cycle, it is essential to engage in honest self-reflection and identify the factors contributing to overspending. Developing a realistic budget and adhering to it can help individuals regain control over their finances and prevent the emergence of new debts.

Moreover, education plays a crucial role in fostering healthier financial behaviours. By seeking out resources on personal finance management, individuals can equip themselves with the knowledge necessary to make informed decisions and avoid repeating past mistakes.

Protecting Against Scams in Debt Consolidation

The debt consolidation landscape can be fraught with unscrupulous companies attempting to exploit vulnerable individuals. Unfortunately, many people fall victim to scams promising quick fixes or miraculous debt solutions. Recognising the warning signs of fraudulent schemes is essential for safeguarding one’s financial future.

Individuals should remain cautious of unsolicited offers that seem too good to be true. Reputable debt consolidation providers typically do not engage in aggressive marketing tactics or pressure potential clients into making hasty decisions. Conducting thorough research into a provider’s reputation and verifying their FCA regulation can help ascertain their legitimacy.

Additionally, individuals should never pay upfront fees for debt consolidation services. Reliable firms usually charge fees only after services have been rendered. If a provider insists on upfront payments, this can serve as a red flag indicating potential fraudulent activity.

Remaining informed and vigilant can empower individuals to protect themselves from scams. Engaging with trusted financial advisors and seeking guidance from reputable sources can further enhance one’s ability to navigate the debt consolidation landscape safely and effectively.

Overlooking the Importance of a Long-Term Financial Strategy

One of the most critical components of successful debt consolidation is the formulation of a long-term financial plan. Individuals often view consolidation as a short-term fix, neglecting to consider the broader implications of their financial decisions.

A well-structured financial plan encompasses not only debt repayment but also savings, investments, and budgeting for future expenses. By adopting a comprehensive approach to financial management, individuals can mitigate the risks of falling back into debt and enhance their financial resilience.

It is essential to establish realistic financial goals and monitor progress over time. Regularly reviewing one’s budget and adjusting it according to changing circumstances can help individuals stay on track and maintain financial stability.

Additionally, seeking ongoing support from financial advisors can provide individuals with the guidance necessary to adapt their plans as circumstances evolve. By committing to a long-term strategy, individuals can build a solid foundation for enduring financial health and success.

Crucial Support Resources for UK Residents Navigating Debt Consolidation

For UK residents seeking assistance with debt consolidation, a wealth of resources is available to provide guidance and support. These services can aid individuals in navigating the complexities of debt management and ensuring they make informed decisions regarding their financial futures.

Accessing Financial Advice Services

A variety of organisations throughout the UK offer free or low-cost financial advice services to individuals grappling with debt. These services provide valuable insights into debt consolidation options and assist clients in effectively managing their finances.

Established charities and non-profit organisations, such as StepChange and Citizens Advice, offer expert guidance and support to those facing financial difficulties. These resources can help individuals develop personalised debt management plans, empowering them to take control of their financial situation and work towards stability.

Additionally, local community organisations may provide workshops and resources focused on financial literacy. By engaging with these resources, individuals can enhance their understanding of personal finance and equip themselves with the tools necessary to navigate debt consolidation successfully.

Ultimately, leveraging these resources can serve as a crucial step towards achieving financial stability and overcoming the challenges associated with debt.

Frequently Asked Questions Regarding Debt Consolidation

What is involved in debt consolidation?

Debt consolidation refers to the process of merging multiple debts into a single loan, often with a lower interest rate, thereby facilitating simplified payments and potentially reducing monthly expenses.

How does the debt consolidation process work?

Typically, debt consolidation involves acquiring a new loan to pay off existing debts, resulting in one manageable payment. This can lower interest rates and simplify overall financial management.

What benefits does debt consolidation provide?

The primary advantages of debt consolidation include reduced interest rates, streamlined payments, improved cash flow, and the potential for enhanced credit scores if managed responsibly.

What risks are associated with debt consolidation?

If not managed carefully, debt consolidation can create a false sense of security, potentially resulting in further debt accumulation if underlying spending habits remain unaddressed.

How can I choose the right consolidation option for my needs?

Consider factors such as interest rates, fees, repayment terms, and your financial circumstances when selecting the most suitable debt consolidation option to ensure it aligns with your goals.

Are scams common in the debt consolidation sector?

Yes, the industry can indeed be rife with scams. It is vital to conduct thorough research on providers, verify FCA regulation, and avoid upfront fees to protect yourself from potential fraud.

How can I enhance my credit score through debt consolidation?

By consolidating debts and consistently making timely payments, you can gradually improve your credit score, as regular repayment showcases financial responsibility and reliability.

What should I do if I cannot meet my monthly payments?

If you are struggling to fulfil payment obligations, it is advisable to reach out to your lender to discuss options, such as restructuring your loan or seeking assistance from a financial advisor.

Can debt consolidation completely eliminate my debt?

While debt consolidation can simplify repayment and reduce interest rates, it does not eliminate debt. Responsible management and ongoing payments are necessary to fully settle your obligations.

Where can I access financial advice services in the UK?

Numerous organisations, including StepChange and Citizens Advice, offer free or low-cost financial advice services to assist individuals in managing their debts and effectively navigating consolidation options.

Connect with us on Facebook for more insights!

This Article Was First Found On: https://www.debtconsolidationloans.co.uk

The Article Debt Consolidation Myths Busted: UK Stories Uncovered Was Found On https://limitsofstrategy.com

The Article Debt Consolidation Myths Uncovered: UK Insights Revealed found first on https://electroquench.com